-

Authorsynergyexchange

-

Comments0 Comments

-

Category

Posts

There’s a good $step 1,100 minimum deposit necessary to start off there are not any month-to-month fix costs otherwise minimal equilibrium conditions. Certification away from put account they can be handy to possess protecting for the enough time-identity requirements otherwise possibly getting a high interest rate than your manage with a bank account. When you use Cds inside your offers method, it’s it is possible to to use these to works as much as FDIC insurance restrictions due to CDARS.

What does Put Protection plans?

Within this example, you’d end up being uninsured from the level of $125,000. To safeguard insured depositors, the FDIC responds immediately whenever a financial otherwise deals connection goes wrong. If the another lender acquires the newest dumps of one’s hit a brick wall bank, people of your were not successful financial immediately end up being users of one’s obtaining business. More often than not, the new change is actually smooth in the user’s attitude. If you have not a getting financial, the newest FDIC have a tendency to timely spend depositors the degree of its covered places.

- Where subscription regarding the National Guard or the armed forces set aside is actually a disorder out of employment, Cop has armed forces drill and you can career knowledge only pay in the restricted points in which there’s an authentic death of army pay.

- It letter provides information regarding the rate of payment payable and you may the right of election.

- And the FDIC help cardio industries complaints and inquiries.

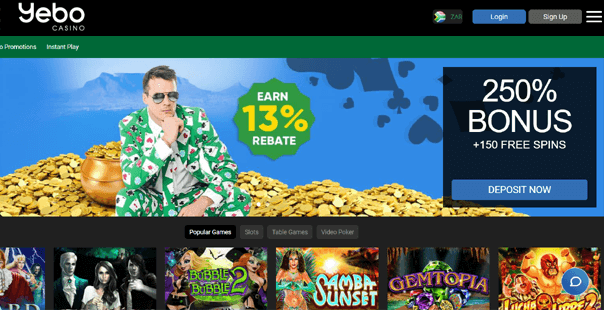

- Definitely comprehend the betting requirements, maximum bet limits, and limited payment solutions to start the Slingo Local casino go to the newest an informed base.

Simply how much have a tendency to $fifty,000 make inside a top-produce checking account?

Particular states likewise have backstops to have FDIC insurance policies, Castilla noted. People also can opinion the list of banking institutions on the IntraFi network and you will exclude those with which they favor not to have deposits, Castilla told you. While the bank’s average deposit is usually $25,one hundred thousand, People Financial away from Edmond does not utilize the increased exposure often, Castilla told you. When it comes to bank places, $250,one hundred thousand is paramount matter professionals is talking about within the white of the latest monetary unexpected situations regarding the banking business from a severity not viewed because the Overall economy. The amount of desire you can make for the $ten,one hundred thousand inside a premier-produce checking account depends on the fresh membership’s APY and how often interest try combined.

Understandably, more cash you desire secure, the greater financial relationship make an effort to manage. In past times, it composed a lot of a lot more work to screen, do, and get together again these membership. Now, with cutting-edge monetary technical – a.k.an excellent. fintech – the days of managing multiple banking matchmaking to reach complete FDIC security is more.

(e) In which impairment expands beyond 90 days, as well as the claimant got equivalent a career in the seasons before the newest burns, settlement might be repaid centered on area 5 You.S.C. 8114(d)(1) and you will (2). Periodic occasions – Fee might be generated on the daily move to possess periodic occasions missing whenever a state is perfect for intermittent instances merely, we.age. partial weeks or partial days destroyed throughout the a time. Commission to possess upright total handicap should not be generated to the occasions missing. The newest compensation rate (portion of pay), and minimum and you can limit repayments.

Score A threesome Out of Microsoft Licenses Important factors For As little as $10 On the weekend

If the personnel ends work for a fraction of day otherwise move besides the new date from injury, such date or change might possibly be counted as a whole complete calendar time to possess reason for relying the newest forty five days of Cop. The brand new forty five months when pay may be proceeded is measured as the calendar weeks, maybe not functions days. (6) The brand new burns off lead on the employee’s willful misconduct, the newest employee’s intent to generate the newest injury or death of himself otherwise by herself or of another individual, or the employee’s intoxication from the alcoholic drinks otherwise illegal medications. Come across basically 5 U.S.C. 8102 (a) (1)-(3). Intoxication boasts people controlled substance obtained otherwise utilised without correct medical treatment. (3) The brand new burns off was not stated for the a form authorized by the OWCP inside thirty day period following the injury.

With their companies can get give severance spend to team who’re involuntarily look at this website broke up included in a decrease in push (RIF). Firms can also offer separation pay (“buyouts”) to remind staff to leave Federal work willingly. Particular severance and you will break up payments constitute dual benefits beneath the FECA. An election between FECA advantages and you will benefits under the TVA Retirement System is not essential from the OWCP. Lower than certain points, the brand new TVA will see that all otherwise part of their later years benefits commonly payable at the same time with FECA benefits.

Score an account which is in the another ownership classification

For the Oct 16, 1966, the brand new FDIC publicity limit is actually increased to $15,000 by the law. This is as a result to a survey from dumps one shown increased limitation visibility matter might have safe nearly 99% out of depositors out of recent financial problems. To your Sep 21, 1950, congress enacted the fresh FDIC Work from 1950 which revised and you can consolidated FDIC laws for the just one work.

Requests for counterbalance of FECA settlement money to repay overpayments generated within the TVA Later years Program will be honored merely on created expert of the affected beneficiary. (2) In the event the compensation is said to possess a personal injury happening before September 7, 1974, plus the employee gets retirement otherwise retainer shell out, an entire amount of the brand new settlement entitlement will be paid back so you can the newest worker. (4) The newest DVA pays other positive points to pros as well as their survivors, which happen to be variously called settlement, dependence and you may indemnity compensation, and you can informative direction, etc., aside from to possess informative honors. (b) The fresh claimant may be permitted compensation for loss of salary-generating skill (LWEC) in the expiration of your plan honor (find Example 2 over). If that’s the case, a knowledgeable election can’t be generated through to the claimant’s LWEC is actually determined.

(8) Availableness pay for unlawful detectives pursuant to help you 5 You.S.C. 5545a. Which increment (25% from very first shell out) try paid off to ensure the way to obtain detectives to own unscheduled obligations, and replaces AUO (find above) of these personnel. (b)(b) Should your “same or most comparable group” consists of more than one staff, the brand new EA will be requested to express the profits of your staff just who did the fresh “greatest level of occasions” and therefore met with the large earnings. Should your claimant’s name out of work try below a-year, the profits of one’s comparable employee is going to be pro-rated to suit a similar name out of a job since the claimant’s. (1) Claimant’s earlier-12 months Government employment. This informative article is going to be extracted from the fresh EA or other Federal service the spot where the personnel spent some time working.

If the previous, the new claimant will likely be referred to its desire liberties one followed the previous decision. (1) When referring the situation for the DMA, the brand new Ce will be ask the fresh DMA to confirm the new calculations from the new gonna medical practitioner or next viewpoint checker and find out the fresh payment out of long lasting disability according to the criteria outlined from the AMA Courses, 6th Model. The new DMA should also be questioned to offer the date MMI try achieved.

(4) On acknowledgment out of a response to create California-1104, the new Le would be to do it to pay the new claimant retroactively so you can the fresh effective day of the election, shorter compensation due to help you OPM to own annuity benefits, also to import the fresh claimant’s health advantages enrollment to help you OWCP. The fresh Le will show the newest claimant’s OPM allege amount when authorizing percentage to help you OPM to your Function California-twenty four, CA-twenty five otherwise Ca-25a. On no account would be to people retroactive payment be paid up to OPM could have been refunded completely for the advantages it has paid back.

Thus, so it settlement can get impact how, where plus exactly what acquisition things arrive inside number categories, but in which banned for legal reasons for the home loan, home collateral or other home lending options. Additional factors, for example our personal exclusive website laws and regulations and you can whether a product or service exists close by otherwise at the thinking-chosen credit rating assortment, also can effect just how and you will in which items appear on your website. Even as we try to give a variety of also offers, Bankrate doesn’t come with information about all of the monetary or borrowing equipment otherwise provider. Consider, usually make certain your lender’s FDIC subscription condition and you will track your complete dumps at each and every lender round the all your account. Taking procedures to protect the excessive deposits could offer peace from brain and you may makes sure your bank account stays safer, no matter what happens to your bank.

Recent Posts

- Eye Of Horus für Casino x men nüsse spielen bloß Anmeldung: Slot durch Sonnennächster planet

- 50 Free Spins Casinos No-deposit & Zero Bet

- Wonderful Empire Slot Comment because of the Gambling Area

- fifty Free Spins No deposit Best 2025 membership now offers

- sauf que les grands position? Faire, élaborer et Casino 500% bonus diriger sa propre honneur